Never Budget Again

Get a personalized set-it-and-forget-it system for managing your money so you can get back to your life.

Finally, my fellow lawyers can answer the question — where does it all go?

If you’re someone who…

Wants a clear picture of where your money is going

Knows there’s a hidden surplus that slips through the cracks each month

Hates relying on apps that require constant updating and reconciling

Enjoys following a clear, efficient process to get results

Has NO interest in tracking every dollar you spend (especially after tracking every billable minute)

You deserve something better.

Do you obsessively check your account balance, only to feel lost in terms of where you stand money-wise?

Are you buried in spreadsheets and budgeting apps but not making progress in any financial area?

Your money management might feel like this right now…

You have money all over the place and no easy system to manage everything…checking, savings, multiple credit cards, and you can’t keep track of how much you truly have at any point in time

You’re trying to stay on top of the newest budgeting app but it keeps losing the connection, miscategorizing your transactions, and showing everything in the red, so you’d rather just ignore it all together

You just got your credit card statement and saw the interest charge and you’re sick to your stomach…so you get in another fight with your partner about paying off the cards once and for all but neither of you know where all the money went

Your partner doesn’t understand all your spreadsheets and you have to go over everything anytime they have a question about whether you can afford something, and now you’re the money police :(

Your partner insists on walking you through their complicated spreadsheets every time there’s a money issue, and you’d rather pull your hair out than sit through that nonsense

You’re making more money than you ever have before, but you don’t seem to have much to show for it and you wonder…where is it going???

You need a simple solution that doesn’t require fancy tech or syncing accounts

Hi!

I’m Jessica Medina, lawyer turned Accredited Financial Counselor. I graduated from Columbia Law School as a single mom of twins with over $200,000 in student loan debt. I practiced law for nearly 15 years (Biglaw & the SEC) before changing careers. I’m now on a mission to help more lawyers figure out the money so they can live their dream lives.

What would it feel like to have an easy system in place where you’re making progress on your money goals, without resorting to ramen noodles?

With a personalized cash management system, you will…

Have a clear picture of what’s happening with your money on a day-to-day basis so you can feel confident making financial decisions based on just a few key metrics

Spend less time worrying about money, freeing up time for the things you truly enjoy

Finally make progress on your big financial goals (paying down debt, saving for a dream vacation, new house, college savings) that used to just fall by the wayside

Fight less with your partner about money stuff and have an agreed-upon system for setting and reaching financial goals

Spend guilt-free on things that are important to you — vacations, gifts, private tutors, charitable giving, date nights, concerts, spa getaways

Be ready to ditch your spreadsheets!

I know what you might be thinking…

I’m too busy to organize or pay attention to managing my money

I’m not good at math and hate numbers — that’s why I went to law school!

Money is a super emotional topic that causes stress for me (and my partner)

My pay is irregular and/or unpredictable — hello law firm owner distributions

I’ve tried all the apps and none of them worked

I haven’t been able to sustain any other budgeting system (do folks still use the envelope method?)

“The Cash Management System is, dare I say, life changing?!? I feel like I have such a great grasp on what I can do with my money now, plus if an emergency comes up, I really know I'm covered, which is so reassuring. It's been a useful and FUN experience.” Susie B. (former lawyer - currently enjoying a self-funded sabbatical)

K.B. (law firm partner)

“I liked that you helped us develop a system that allowed us to prioritize our financial goals in a way consistent with our values. We can still choose to spend money on the things we enjoy, but we know how to prioritize our financial goals.”

H.F. (in-house counsel) on benefits of system:

“Gaining control of your financial life and putting the system to work so that you don’t have to think about money on a daily basis.”

I HELP LAWYERS WHO OBSESSIVELY CHECK THEIR ACCOUNTS GO FROM BURIED IN SPREADSHEETS TO A SIMPLE, STREAMLINED SYSTEM FOR MANAGING THEIR MONEY

Let’s build you a personalized cash management system that works for your life

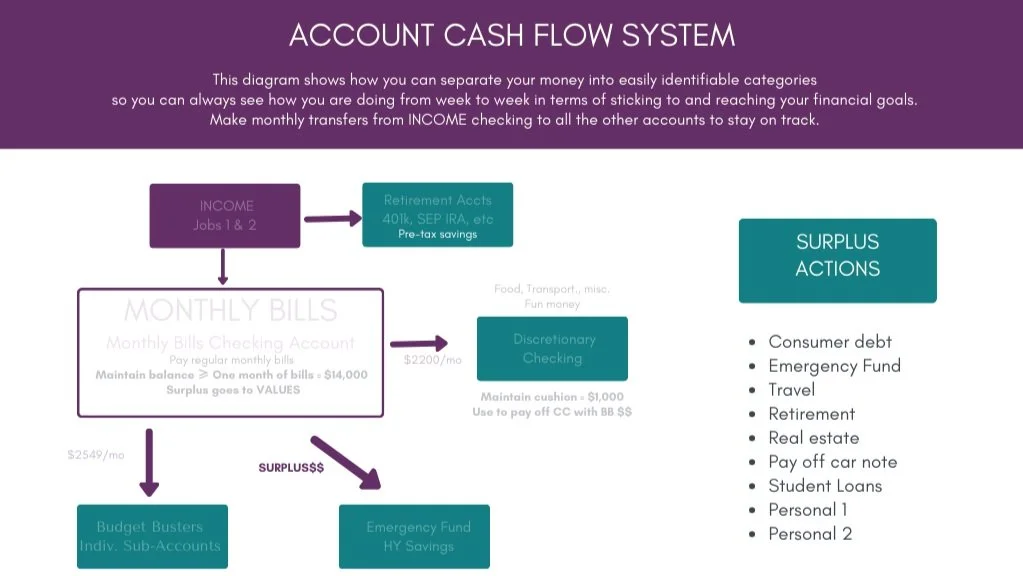

Proven Framework For Organizing Cash Flow

Customized Map of Your Money and Spending

2 Live Sessions For Personalization and Support

Over the course of our two Cash Management sessions together we will:

1

Map the Money

We’re going to take a nonjudgmental look at your income and spending together and decide where your money is going once and for all

2

Create Your Personal System

You’ll learn my proven method of organizing your money to work for you and get the specific steps you need to follow and stay on track

3

Capture the Surplus

The system is designed to automatically show you when you truly have extra so that surplus can be put toward your top money goals

These 3 steps are the process and framework that I’ve used with over 100 lawyer clients.

The end result?

Their stress levels are down and their net worth is up!

And it works for me, too – I’ve implemented this cash management system in my own life and it allows me and my husband to enjoy our semi-retirement as we move to the next phase…building a vineyard in the Great Smoky Mountains.

Are you a good fit?

GREAT FIT…

✅ You know you’d have more money at the end of the month if it weren’t slipping through the cracks

✅ You’re not interested in tracking every dollar you spend

✅ You enjoy following an efficient process with clear instructions

NOT SO GREAT FIT*…

❌ You’re running a large deficit every month with no end in sight

❌ You’re getting ready to make a big transition (change career, growing family, divorce)

❌ You and your partner have very different money goals

*Don’t worry, I help folks like you in my comprehensive 6-month coaching program (and you’ll still get a personalized cash management system)

The biggest issue with cookie-cutter budgeting systems is that they’re not built with YOU in mind.

Here’s what your $2,500 investment gets you:

2 Live Sessions

We go over your income and spending together on Zoom in a nonjudgemental fashion so I can build a system that reflects how you live your life. Then we review your system together.

Training Video

You’re going to learn exactly how I approach money management and how I organize my clients’ income, accounts, and spending to create a clear path to surplus.

Personalized System

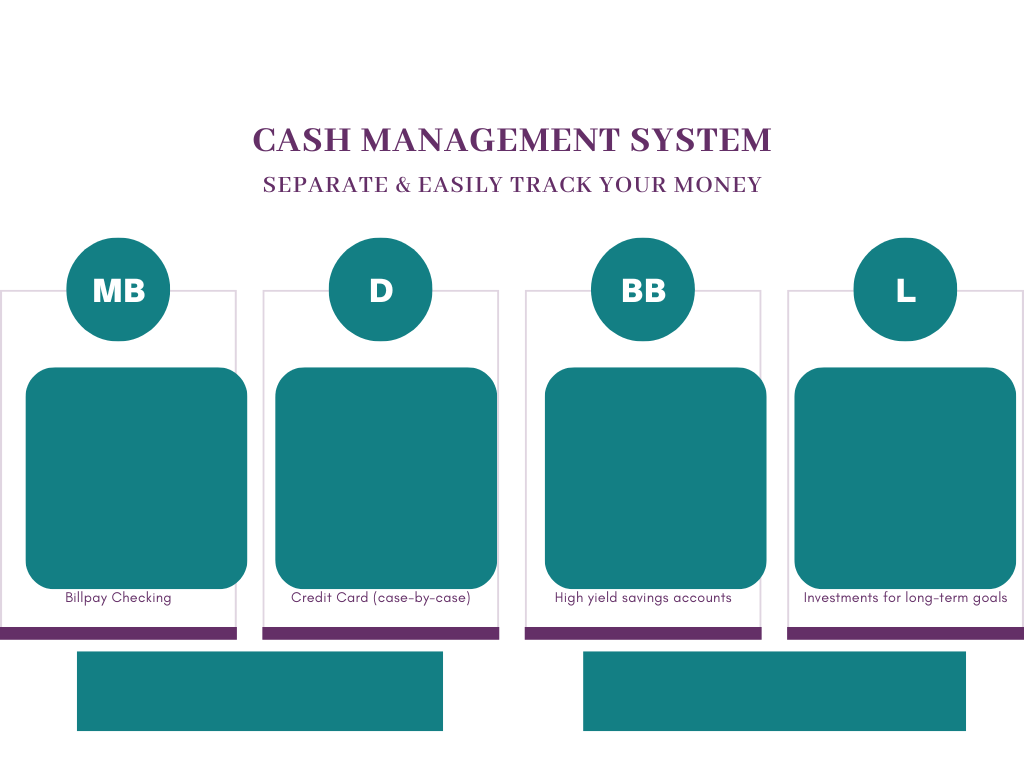

You’ll get a colorful PDF that shows exactly how to set up your accounts, how the money flows through the system, and what to do each month to stay on track.

Money Checklist

You’ll get a short list of the exact steps you need to follow to maintain the system for years to come, no matter the changes to income or spending.

NEVER BUDGET AGAIN: BUILD A PERSONALIZED CASH MANAGEMENT SYSTEM

$2,500

The current investment for this program is $2,500. A payment plan is also available ($500 deposit plus two additional payments of $1,000 due prior to each session.) Choose your preferred payment option when signing up.

This investment is a fraction of the amount my clients are now able to put toward paying down debt, increasing their savings, and lowering their overall stress levels.

Not to mention having a system that everyone understands and can adapt as needed when life changes.

Please note: This program is not meant to replace the more comprehensive 6-month program (currently $7,500) which evaluates larger financial strategies, covers transition planning, and offers continuous support.

What might it cost you if you don’t create a simple, streamlined system for managing your money?

I wasn’t very good with money when I was an associate in Biglaw and it showed. I shudder when I think of how much money I wasted just because I couldn’t really see what was happening in real time and where it was all going.

I had too many other things to do and figuring out my finances was the last thing on my list. It didn’t help that no one ever taught me a good system to manage everything.

It took me wanting to leave the law to finally get my act together.

And I don’t want this for you.

Let’s not waste another payday to bad money management…let’s build a powerful, personalized cash management system together.

Frequently asked questions…

Will this program solve all my money problems?

If I could do that in 2 sessions I’d be charging a lot more than $2,500! But seriously, this program will give you the exact tools and framework you need to get your income & spending organized so you can capture that beautiful surplus. The best use of that surplus (and how to plan for big life changes) is covered in my comprehensive 6-month program so if you need that guidance consider that program instead.

I’m not a Biglaw attorney, will this work for me?

Yes!

I’ve worked with clients from all walks of life (Biglaw, Small Firms, Nonprofits, Government, and those with no interest in law) and my strategies and cash management techniques apply to all situations. I’ve worked with firm associates, partners, solo practitioners, in-house counsel, single income households, and two-income households and each system is designed for each unique situation.

What if my income is irregular?

No problem.

I’ve built dozens of cash management systems for attorneys (and other professionals) with irregular income — hello my solo practitioners and law firm partners! The system can also handle one-off income such as rentals, side gigs, bonuses, etc. The beauty of a personalized system is that we’ll take all your income and spending into account and design it so it works for your actual life.

Does this work for couples?

Absolutely. The majority of my clients are in committed relationships where they are sharing finances in some respect with a partner. And I pride myself on creating a safe space where each partner can talk about their concerns, their priorities, and their goals so the system reflects everyone.

And this is all personalized for a reason!

Whether you prefer to maintain joint or separate accounts (or a mix), my clients run the gamut so I have plenty of experience designing systems that work for every family. We’ll discuss your preferences and the pros/cons of each option before building your personalized system.

And each partner will have a clear picture of how the system works so you can have truly productive money conversations from now on.

I’m in, what do I do next?

Great! Click the button below and choose your payment option. Once you're signed up, you'll automatically get access to my calendar to schedule your first cash management session.

So excited to build your system with you!!!

Hello again!

I’m a lawyer turned Accredited Financial Counselor so I marry an intimate understanding of lawyer life with the personal finance strategies that actually work for attorneys. I graduated from Columbia as a single mom of twins with over $200,000 in student loan debt, took a stroll through Biglaw and the federal government, and now I help attorneys finance their dream lives.

The first thing all my one-on-one clients do with me when we meet is figure out where their money is actually going. I’m bringing my personal attention along with my proven framework for organizing your income & spending so you can make positive financial changes.

Get real clarity on where your money is going and finally capture that beautiful surplus so it can work as hard as you do!